Grain Snippets: Rabi Crop Potential Plugs up Pulse Demand

Demand on all pulses has eased over the last fortnight as the Indian rabi (winter) crop progresses well and coronavirus concerns cause market confidence to wane. Harvest of the rabi crop has now started in India’s southernmost growing areas, and will continue to pick up pace as its progress moves north over the next six to eight weeks into Pakistan and India’s main pulse-producing areas. This generated a shift in market interest away from imports and toward its own domestic production.

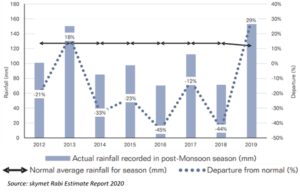

Rabi Pulse Crop – Unseasonal monsoon rains brought turmoil to India’s Kharif growing season in 2019 and caused some delays to the rabi planting. The monsoon season overran by almost a month due to the extended nature of the negative Indian Ocean Dipole; the rains from which were the heaviest witnessed in India in 25 years. The initial planting delays to the Rabi crop have been resolved, with area now above that of last year, up 6.2% at the end of Jan for all pulses. Of note, chickpea area is up about 11.4% compared to the same time last year. The high rainfall across the country in late September and October have provided a high level of soil moisture, with post-monsoonal rainfall recorded at 29% above normal nationally. The main beneficiaries were North-West and Central India, both key growing regions. It is expected that pulse crops will be large, though some forecasts peg the Indian lentil crop only marginally up on last year. The remaining question over the crop is that of yields, the results of which will come to light as harvest progresses.

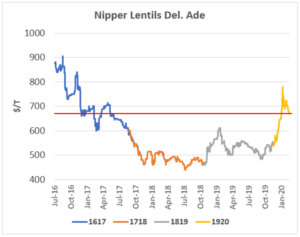

Lentil prices have continued to slide lower on reduced market optimism and end-user demand. Delivered Adelaide prices are now circa $670-$680/MT for nipper varieties, with larger varieties at a discount of about $20/MT. This pricing level remains above lentil bids over the last two seasons so growers making small sales now will benefit from higher relative prices ahead of the potentially large rabi crop. April is when we can expect some more volatility with potential support for lentil prices as traders seek to maintain coverage into the Ramadan-based Eid Al-Fitr festival; this year Ramadan lasts from 23rd April – 23rd May, so the festival (and subsequent high lentil use) will occur directly after on the 23rd-24th May.

India’s Imports – This year’s potential high production from India’s Rabi (winter) crop could cause a slump in imports for the year ahead. The Indian government readily imposes measures to curb overseas purchases to support domestic prices, so a bumper crop this year in India could negatively impact pulse export countries like Australia and Canada. Since record imports of pulses led to a crash in India’s domestic prices in 2016-17, India imposed import quotas and has tightened loopholes to ensure traders do not get to import beyond these quotas imposed by the government. That being said, the state department still utilizes a buffer stock of pulses to ensure a certain level of domestic price stability so there will always be an ebb and flow to India’s demand to keep this stock in balance. With the rabi crop harvest getting underway as of this month we can expect that much of this stock will come from new domestic supplies.

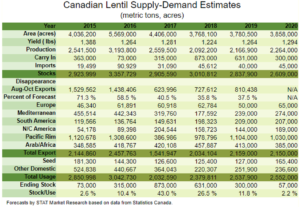

Canadian exports have lifted for February, with the Canadian Grain Commission reporting 66,500 MT of bulk lentils were loaded for export in the first week. This has raised their season-to-date bulk lentil exports up to 425,500 MT compared to 293,400 MT for the same time last year, an increase of 45%. Though average quality was down from last year, exporters have had no difficulty meeting shipping commitments for No 2 grade lentil product. This suggests a good proportion of old crop lentils continue to move, further drawing down on available stocks for the remainder of the marketing year. Canadian lentil stocks-to-use are forecast at 11.8% on a recent revision to carry-in stocks from the 2018/19 season. Looking ahead, the long-term outlook for Canada remains somewhat positive for price relative to the last couple years due to the low forecast available stocks year-on-year.

This is a sample only, if you would like to view the entire document and our recommendations, please contact CloudBreak to discuss becoming a member on (08) 8388 8084.

–