Barley Market: IMI Residue Levels Update

Edit: 24th June 2019

Graincorp have announced this morning, that growers who deliver Spartacus CL or Scope CL to Graincorp sites (eastern states) will have to declare the use of Imidazolinone chemicals upon delivery. Alongside this, Graincorp will also segregate all Imidazolinone treated Spartacus CL and Scope CL into Feed Barley segregations this harvest. These precautions will be undertaken to ensure that barley delveries to the Graincorp system can be suitably assessed agaisnt the MRL limits for their key export and domestic markets. This notice was provided by Graincorp with a strong reccomendation for growers and agronomists to carefully consider the use of Imidazolinone chemicals this season.

As many southern barley crops are now in the emergence stage and the first in crop sprays are being applied, CloudBreak would like to take the time to highlight the most recent update available on the current barley minimum residue levels that are likley to impact the malt market this year.

Background

In late March 2019, a statement was issued by Barley Australia, alongside key industry bodies, to raise awareness about the use of IMI herbicides on Clearfield barley varieties (Scope CL & Spartacus CL) this season. This statement came about due to concerns over market access for malt varieties as current maximum residue levels (MRL) in Japan and South Korea (our third and sixth biggest export destinations) sit below the maximum residue tolerance for IMI in Australia. Even if the use of IMI chemicals is conducted in accordance with Australian Product Safety labels, it does not guarantee that the residue levels will meet MRL in overseas destinations.

In a quote from the statement “The Australian barley industry has a good record of compliance with market requirements. To maintain this strong performance, the industry needs to work together to consider recommended management practices and market plans to ensure continued access to our international markets in the coming season”.

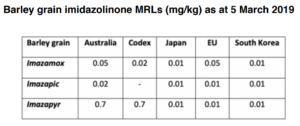

The below table was published in the statement and shows the variances between Australian MRLs, Codex (default) MRLs, and overseas destinations.

The key points from the statement included:

- It is recommended that growers carefully consider the use of imidazolinone chemicals on their IMI tolerant barley varieties (Spartacus CL or Scope CL).

- Industry is working with key markets (such as South Korea and Japan) to establish appropriate import tolerances for imazamox, imazapic and imazapyr.

- Growers should be mindful of their intended grain sales options for the 2019 harvest. There will potentially be a requirement for a commodity vendor declaration process. Growers are encouraged to contact their local grain traders for further information.

If you wish to read the full statement click here.

Moving Forward

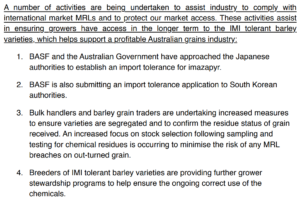

The below excerpt from the statement defines what is currently occurring in the industry to mitigate the risk of decreased market access, should MRL limits remain unchanged in Japan and South Korea.

Although industry bodies are currently approaching various importers to discuss revising the MRLs for barley, it can be a very time consuming and complex process, therefore, a timeline of when the issue will be resolved is still unknown. At this stage, they are not expecting to have a revised MRL within these export destinations before the 2019 harvest.

Now that the adoption of these Clearfield varieties has grown within industry to account for almost half of the national barley crop, marketing of this product is becoming increasingly difficult where MRLs are lower.

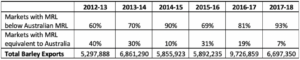

The below table (from original statement) highlights the difference in recent years in regard to the percentage of export destination that have MRLs on par with Australia, versus those that are lower. It highlights the increasing trend of overseas destinations reducing the MRLs as consumer perception of chemical use changes.

The latest information from GTA is below and outlines their recommendations to GTA members and exporters. This information is the latest update we have.

“Given the potential restrictions on market access to various destinations for these barley varieties, GTA Members are advised to consider the commercial implications of the issues detailed in the joint industry statement that has been issued. These issues may include, but not be limited to:

- Potential price implications due to limitations on access of grain held in storage on destination markets;

- Potential implications on forward contracts;

- Ensuring appropriate and accurate information is obtained and included in Commodity Vendor Declarations provided by growers and other suppliers;

- Appropriate segregation and co-mingling strategies are implemented to minimise market access risks. Members should consult with their storage operators to ensure appropriate segregation and stock selection processes are in place.

- To meet obligations outlined in the Australian Grains Industry Code of Practice, when purchasing stock GTA Members should establish full and prior knowledge of the residue status of the inventory prior to positioning and commitment of grain for export”.

At this stage growers should ensure they keep up to date with agronomic advice when using IMI chemicals and speak to local bulk handlers in regard to segregation plans and/or vendor declaration forms that may change in the lead up to harvest in order to avoid any negative ramifications.

For access to the original and updated industry statements, please see below links:

Original (March 2019): Link

Updated (May 2019): Link

GTA update (June 2019): Link